Within the boundless ocean of fast financing choices today that is available the financing world, debit card loans have not gotten much prominence at the moment. Restricted understanding of this scheme means more possibilities for anyone well-informed.

Fundamentally, debit card pay day loan is a group of cash capital directed directly to your debit card. Obviously, you need to acquire card that is such gather funds. Dropping within schemes of short-term funding, minimal pre-requisites are compulsory for approvals. Borrow as much as $1,000 with a quick one-page application!

Debit card loans online

The epoch of Web revolutionized company strategies, procedures and systems.

Following a suit, debit card loan companies offer countless opportunities for astute candidates to lodge online. Now seekers can receive urgent funds after filling out simplified types without faxing documentary confirmations of employment, week-long credit checks, and sometimes aside from “bad credit” reviews. Consistency of submitted information is examined straight away with this specific paperless choice.

The procedure is fundamentally instant, with money transfers processed momentarily when approvals are through. Without delays, funds could possibly be used for purchases, payments, and money ATM withdrawals.

Submit an application for a debit card loan

System-wise, applications are really fundamental. Minimal requirements for debit card owners include: age, work, residency.

- Age: 18+

- Employment: 12-week+ consistent employment

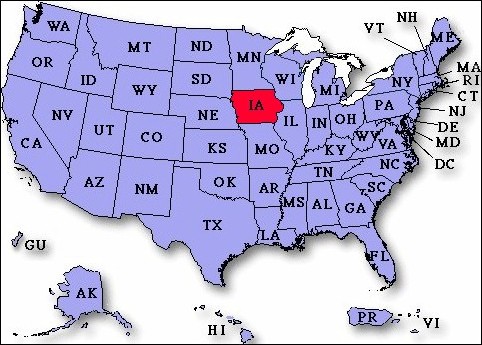

- Residency: United States Of America

To utilize, finish the submission that is one-page, are the amount of debit card money needed. Funding available under this scheme begins from $100. Cash sums reaching $1,000 could possibly be required.

With this distribution kind, you have to finish all compulsory areas: complete contact information, names, details, contact cell phone numbers (ideally your mobile). Remember to make sure correct spellings. To obtain swift approval, proper information for cross-referencing is really important. Also essential to validate precision of all figures, such debit card account number, which funding must be used in.

When needed areas are finished, which takes many people under 5-10 minutes, be sure you look for mistakes, and press “Submit”. Keep in mind that details are stringently confirmed, and furnishing information that is erroneous cause delays. Non-USA residents are ineligible under this scheme of faxless, paperless loan submissions. Considering that eligibility conditions are met, cell phone confirmation shall stipulate imminent arrival of funds.

Charges for such loans fluctuate between providers, nevertheless, generally speaking must fulfill limits depending on relevant industry laws.

Competition among vendors brings fees down. General awareness needed to correctly evaluate proposals from various manufacturers may be supplemented through online comparison charts by multi-vendor sources. Consequentially, internet sites featuring provides from diverse sources may potentially help in picking options better worthy of specific circumstances. Any crisis needing cash solutions could potentially justify implementation of the system.

Improving the current ease of debit card financing schemes, payment withdrawals are automatic, eliminating needs for establishing client-side transfers. Debit dates are conveniently linked to paydays. Loan rollovers could possibly be considered, although extra costs apply. Effortlessly, conditions for complete repayments would guarantee the mortgage conclusion.

Obtaining a Universal Credit cost management advance

You could be capable of getting a loan in your Universal Credit if you wish to protect an expense that is specific that is called a ‘budgeting advance’.

In the event that you obtain a cost management advance, you’ll receive paid off Universal Credit repayments unless you’ve paid down the total amount you borrow. This can ordinarily be over 12 months.

You are  able to submit an application for a cost management advance to pay for such things as:

able to submit an application for a cost management advance to pay for such things as:

- a one-off product – eg replacing a fridge that is broken

- work-related costs – eg purchasing uniform or tools

- unanticipated costs

- repairs to your house

- travel costs

- maternity costs

- funeral costs

- going expenses or hire deposit

- important things, like garments

If you have sent applications for Universal Credit but have actuallyn’t had your payment that is first yet you will need to get an advance re re re payment rather than a cost management advance.

Whenever a budgeting can be got by you advance

Unless you will need the cash for work-related expenses, like train tickets to job interviews, you will have to have reported any one of these brilliant advantages for half a year or even more:

- Universal Credit

- means-tested Jobseeker’s Allowance,

- means-tested Employment and Help Allowance

- Earnings Help

- Pension Credit

You can also must have received lower than ВЈ2,600 within the six months before the job. This figure is ВЈ3,600 if you should be in a couple of.

You cannot obtain a cost management advance in the event that you or your lover continue to be paying down a past cost management advance.

Just how much you are able to borrow

The budgeting advance that is smallest you may get is ВЈ100. The utmost is determined by your position. You are able to borrow around:

- ВЈ348 if you should be solitary without kids

- ВЈ464 if you are in a few without kids

- ВЈ812 when you have kiddies

When you have a lot more than ВЈ1,000 in money

Money includes any cost savings, and some forms of home.

When you have a lot more than ВЈ1,000 in money, the Jobcentre will certainly reduce your budgeting advance because of the extra quantity.

For instance, if you have got ВЈ1,250 in money, the Jobcentre will certainly reduce your cost management advance by ВЈ250.

Obtaining a cost management advance

You will need to submit an application for your cost management advance over the telephone. To choose if you are qualified, and exactly how much you may get, an adviser will glance at:

- If you have any debts and how much you owe to help work this out whether you can afford to pay the loan back – they’ll see

- simply how much you have actually in savings

You are going to usually get a choice regarding the day that is same.

Universal Credit helplineTelephone: 0800 328 5644Textphone: 0800 328 1344Telephone (Welsh language): 0800 012 1888Monday to Friday, 8am to 6pm

Telephone telephone Calls to these figures are free. It’s most useful to phone through the contact number you provided the DWP when you arranged your Universal Credit account. You will have a reduced delay and stay subjected to towards the exact same one who managed past telephone phone calls you have made.

If you are refused a cost management advance. If you are with debt or lease arrears

You cannot impress if for example the application is refused, you could ask when it comes to choice to again be looked at. It can help when you can offer brand new evidence or show that the circumstances have changed as your very very first request.

There are many actions you can take to assist you lessen your financial obligation if you have simply sent applications for Universal Credit.